21% Mental Health Conditions

Mental Health Conditions

Including Post-Traumatic Stress Disorder & Depression

21

%

of all the claims we accepted.

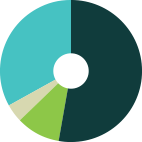

The payments for Mental Health related claims fell into the following product categories:

- 3%

Life Insurance

- 25%

TPD Insurance

- 72%

Income Protection

Did you know?

43% of Australians have experienced a mental health condition in their life.4